child tax credit october 2021

The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of. The ARPA increased the CTC from 2000 to 3000 per child for children between 6 years and 17 years and 2000 to 3600 for children below 6 years.

Child Tax Credit 2021 This Is The Last Day To Opt Out Of Payments Fox Business

For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is.

. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. The Child Tax Credit reached 611 million children in. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks through the mail anywhere from a few days.

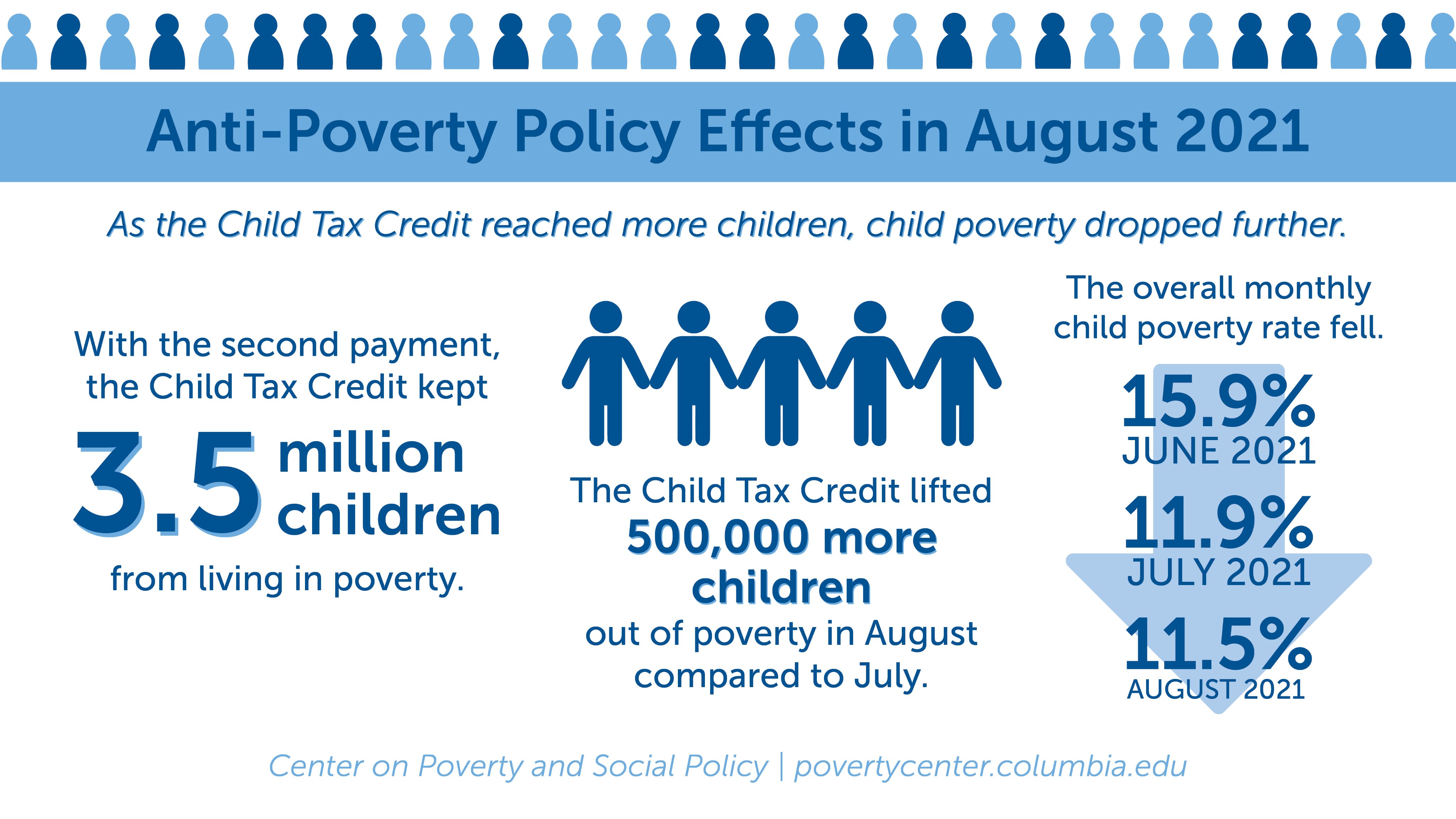

You received advance Child Tax Credit payments only if you used your correct SSN or ITIN when you filed a 2020 tax return or 2019 tax return including when you entered. The law requires nearly half of the credit to be sent in advance. The fourth monthly payment of the expanded Child Tax Credit kept 36 million children from poverty in October 2021.

The age limit was also. An income increase in 2021 to an amount above the 75000 150000 threshold could lower a households Child Tax Credit. This historic support the largest ever credit is.

Have been a US. The credit enabled most working families to. This summer the Biden-Harris administrations American Rescue Plan Act increased the 2021 Child Tax Credit CTC.

Child Tax Credit 2022 3 payments each worth 250 going out this month. 3000 for children ages 6. Families with qualifying children will receive 3000 for each child age 6 to 17 and 3600 for each child under 6.

October 4 2022 Elijah Lucas Stimulus Check 0. As part of the. Child tax credit ever.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out will receive 300 monthly for each child under 6. That means another payment is coming in about a week on Oct.

The IRS will soon allow claimants to adjust their. 3600 for children ages 5 and under at the end of 2021. The Child Tax Credits CTC are set to revert to.

The IRS has confirmed that theyll soon allow. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. October can scare up several reasons to think about taxes including wondering when the next child tax credit payment will arrive.

The American Rescue Plan Act ARP enhanced the CTC for 2021 considerably creating the largest US. Most families are eligible to receive the credit for their children. IR-2021-201 October 15 2021.

The credit enabled most working families to claim 3000 per child under 18 years of age and 3600 per child six and younger. October 29 2021 In October the IRS delivered a fourth monthly round of approximately 36 million Child Tax Credit payments totaling 15 billion. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now.

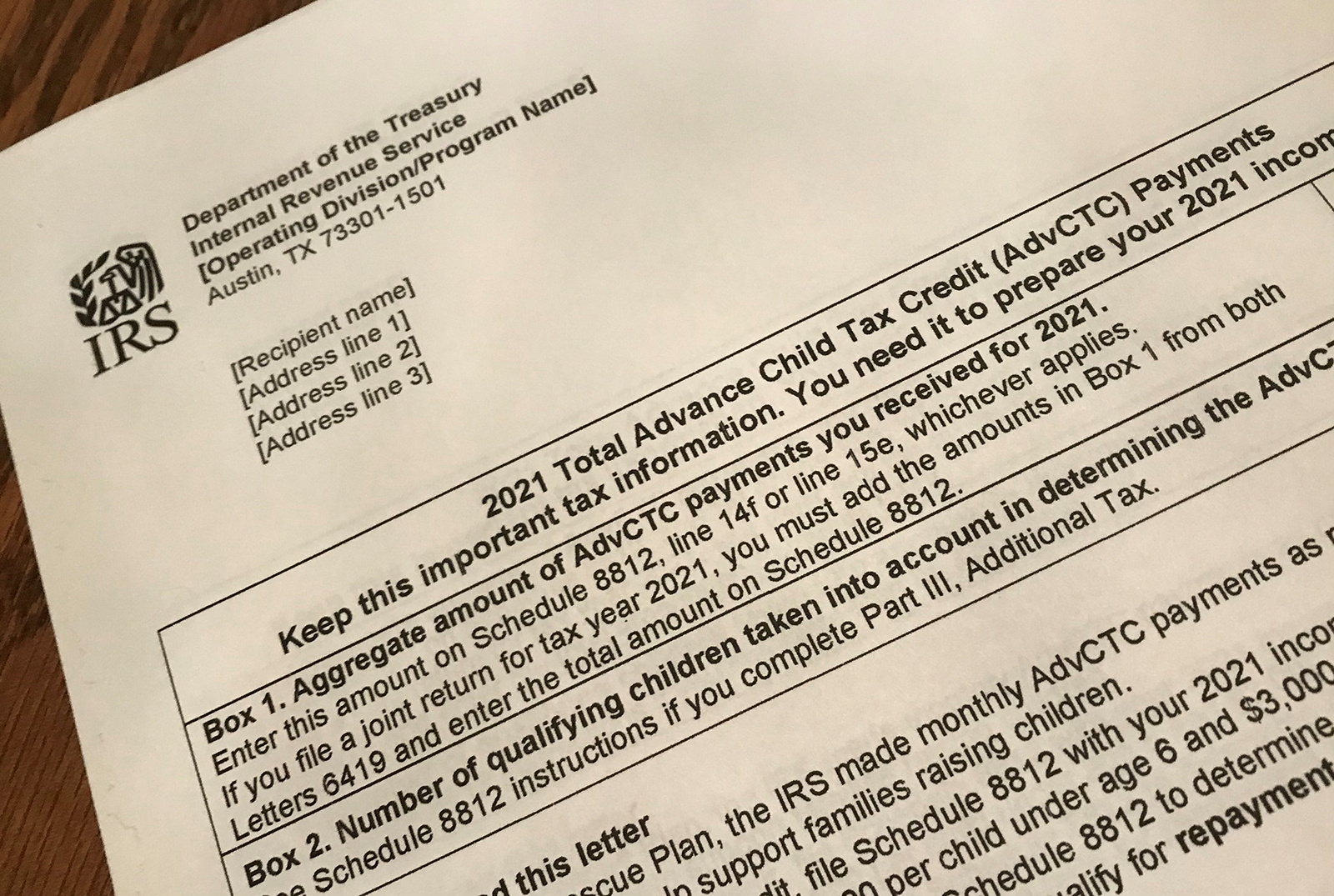

All eligible families could receive the full credit if. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The monthly 2021 Child Tax Credit payments were based on what the IRS knew about you and your family from your 2019 or 2020 tax return.

Changes in income filing status the birth or. An individuals modified adjusted gross income AGI must be 75000 or under or 150000 if married filing jointly to claim the maximum credit of 3600 for a newborn baby in.

What To Do If You Didn T Get Your First Child Tax Credit Payment Newswire

Center On Poverty Social Policy Cpsp On Twitter The Child Tax Credit Continues To Deliver In August 3 5 Million Children Kept Out Of Poverty 500 000 More Children Kept Out

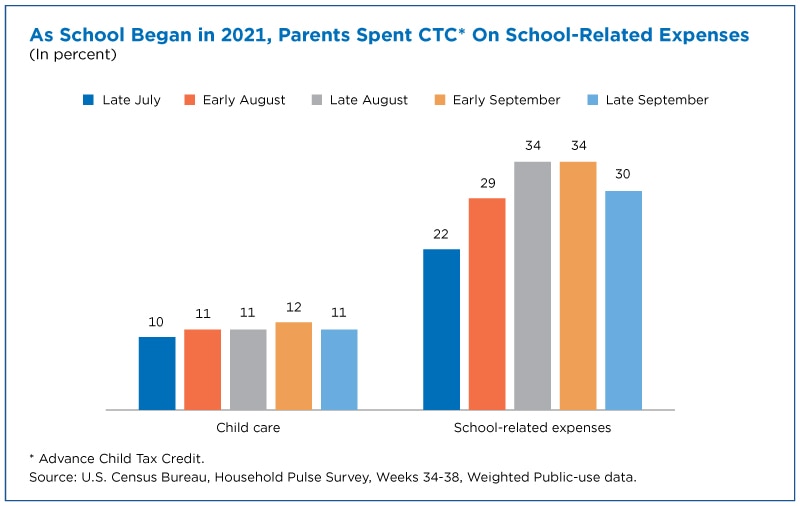

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

While Child Tax Credits May Be Smaller On 2021 Tax Returns Americans Received Up To 1 600 More Per Child Last Year Masslive Com

How The Expanded Child Tax Credit Is Helping Families The Source Washington University In St Louis

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

What Is The Child Tax Credit And How Much Of It Is Refundable

When To Expect Next Child Tax Credit Payment And More October Tax Tips

Child Tax Credit Update Next Payment Coming On November 15 Marca

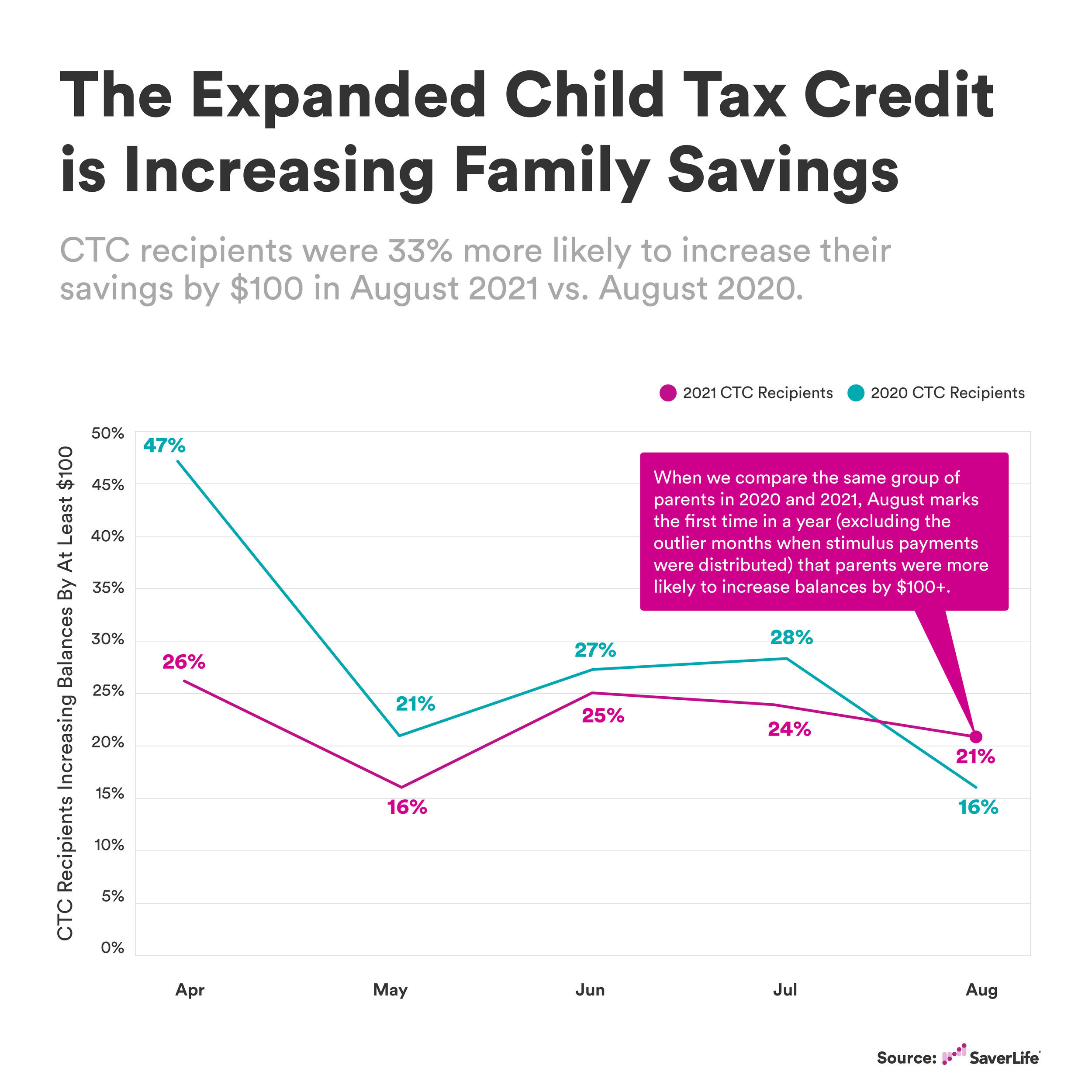

Child Tax Credit Increasing Families Financial Resilience About Saverlife

After Child Tax Credit Payments Begin Many More Families Have Enough To Eat Center On Budget And Policy Priorities

E C Financial Services And Tax Preparation Child Tax Credit Expansion When Will The First Checks Get Sent Out We Know The Child Tax Credit Payments Will Begin Arriving In July But

2021 Child Tax Credit Do You Qualify For The Full 3 600 Wcnc Com

Child Tax Credit 2021 Here S Who Will Get Up To 1 800 Per Child Nj Com

Tax Tip Use The Child Tax Credit Update Portal To Make Changes For Future Payments

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Advance Child Tax Credit Payments Begin July 15

Information On The Child Tax Credit And Eligibility Newsletter Archive Congressman Jamie Raskin

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back